Historical returns are no guarantee of future returns. The money invested in the fund can both increase and decrease in value, and it is not certain that you will receive back the entire invested capital.

Q2 reports for the 10 largest positions in TIN New Technology

Expectations ahead of the reports

Before the reporting period, there was speculation that there would be more profit warnings than usual as more data points indicated that the economy was deteriorating. However, there were not particularly many profit warnings, and the few that were communicated were in different industries. With few profit warnings and low expectations, one could argue that the reactions to the reports should have been mild. That was not the case, however. We saw declines of up to 20 percent in companies that came in marginally below expectations. So how did it go for TIN New Technology's largest holdings? Below are our top 10 positions summarized.

Evolution

The live casino dominator, Evolution, reported a revenue growth of 28 percent. With the company's highest ever EBITDA margin of 70.7 percent, profit growth summed up to a robust 31 percent. The figures are particularly impressive given the global situation. CEO Martin Carlesund admits that it is more challenging to deliver growth in today's environment compared to, for example, 2021. The company is working hard to keep costs down while constantly developing its offerings.

During H2, for instance, Lightning Lotto will be released, which Carlesund highlights as a particularly interesting game launch during the investor presentation. Evolution expects 'immediate success' and we look forward to both existing and new game releases that contribute to continued revenue and profit growth.

Novo Nordisk

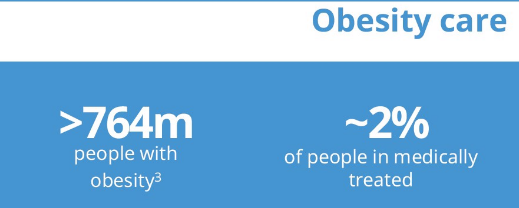

The Danish pharmaceutical giant and cash flow powerhouse, with a market value greater than Denmark's GDP, continues to deliver strong figures. Sales rose by 32 percent to 54 billion Danish kroner, and operating profit increased by 30 percent to 24 billion DKK. The company received extra attention shortly after the release of the report when their research report highlighted that at-risk patients who did not yet have diabetes and used their weight loss/diabetes drug Wegovy reduced the risk of heart attack and stroke by approximately 20 percent.

As we have previously communicated, Novo has transformed from being "just" a leader in diabetes treatment to also helping people significantly reduce their weight. The demand for their weight loss drugs is so high that they are struggling to meet the demand with increased production.

If the company can also provide drugs that reduce the number of heart attacks and strokes, it will likely need to further expand production to meet the anticipated demand.

Paradox

The video game company increased its revenue by 61 percent compared to the same period last year. Operating profit increased by 37 percent. The strong result is driven by a robust core business and many good releases in the form of expansions of varying sizes. The company highlights that the strong dollar contributes to the good result. Fredrik Wester writes in the CEO's statement that the company is gathering strength for what is to come. The company has 10 active games and a dozen in its well-stocked pipeline.

With loyal players purchasing expansions in combination with promising game releases, Paradox is well-positioned for future revenue and profit growth in an exciting and scalable industry. It is worth noting that Q3 is likely to be a tougher quarter, with a lack of major game releases.

Surgical Science

One of the biggest challenges in healthcare globally is how to limit medical errors. Here, Swedish Surgical Science plays an influential role as one of the world leaders in robotic surgery and simulation. The company provides aspiring surgeons the opportunity to practice operations in a simulated environment in a realistic way.

Revenue amounted to 216 MSEK, an increase of 15 percent. Despite rising costs in the education division that could not be offset by sufficient price adjustments, operating profit increased by 23 percent thanks to a high proportion of license revenues during the quarter. CEO Gisli Hennermark writes in the CEO's statement that the market for robotic surgery is developing strongly and that the content for existing customers is expanding.

During recessions, the ability to increase sales to existing customers is critical, as sales to new customers tend to be slower. The scalable license revenues increased by 67 percent, while the results in Educational and Industry/OEM were more tepid. Despite flagging that the company's near-dominant position may mean that market share might drop slightly, Hennermark is clear that Surgical Science is extending its technological lead over competitors.

Take-Two Interactive

It is the American developer and publisher of video games with iconic rights such as Grand Theft Auto and NBA 2K. Revenue increased by 17 percent to 1.3 billion dollars. The company is growing strongly with existing customers and recurring revenues (additional purchases, advertising, etc.) accounted for 84 percent of the revenues in the quarter.

Take-Two, which is partially in a development phase, however, reported a loss of 206 million dollars. CEO Strauss Zelnick communicated that Grand Theft Auto 5 continues to deliver strong figures and the game has sold more than 185 million units up to the report release! GTA6 is expected to be released next fiscal year (one of 17 major releases in the coming years), and the importance of this release is, of course, immense.

Kindred

Kindred is the sustainable gaming operator focusing on sports betting. Revenues increased by 29 percent while underlying EBITDA rose by 120 percent and totaled 56 million British pounds, partly driven by a strong sportsbook margin. The increase in revenue, combined with the scalability of the business model, resulted in a good margin.

The vast majority of revenues are derived from consumer operations. However, the wholly-owned B2B business Relax Gaming is growing explosively and its significance in the group should gradually increase over time. Kindred continues to buy back shares and simultaneously distribute cash dividends without incurring debt thanks to strong cash flows. The company itself owns 6.6 percent of the shares. Kindred keeps pushing forward while they have communicated that the company is for sale

Biogaia

The company develops, markets, and sells probiotic products. It is perhaps best known for its colic drops, which ease the burden for both parents and infants by alleviating stomach pains for the very young and helping them manage daily life. Child health is a larger part of the turnover, but during the quarter, adult health contributed with over 50 percent growth.

Biogaia's total net sales for the quarter increased by 9%, mostly driven by currency effects. However, operating profit fell by 6 percent and amounted to 95 MSEK. The company's net cash not only contributes to financial stability but thanks to interest placements, Biogaia collected 7 MSEK in interest income. Thanks to this contribution, the company managed to increase earnings per share by 3 percent compared to the same period last year.

This also highlights the importance of net cash which is no longer 'just' insurance against potential problems or a potential acquisition tool, but now also a potential source of revenue.

ChemoMetec

ChemoMetec flagged earlier this year that the market for new research projects is more cautious, which negatively affects the sales of instruments. However, the company continues to sell its highly profitable consumables to existing customers to a great extent.

The company does not report quarterly. However, the annual report for the fiscal year was released on September 13, and the company reported a growth of 5 percent for the full year 22/23. Thanks to the highly profitable consumables, the operating result increased by 14 percent. The market hiccuped intraday as the company's forecast for the coming year indicates both a decrease in revenue and profit. An important factor to consider is that the company has historically exceeded its forecasts. In the longer term, however, the market for research projects should improve, and then ChemoMetec is in a strong position.

Embracer

The video game group reported a net revenue increase of 47 percent to 10.5 billion SEK, of which 20 percent was organic. Adjusted EBIT rose by 27 percent to 1.7 billion. The growth was driven in part by the launch of Dead Island 2, but also by the licensing business and the board game group Asmodee. The PC/Console operations showed strong growth. It is worth noting, however, that it was primarily the aforementioned game releases that contributed to this.

The critically important catalog sales, where older games are sold at a discount, did not experience the same growth due to fewer hits last year. Although catalog sales are fundamentally more stable, revenue from it also varies from quarter to quarter. But this also highlights the importance of successful, major game releases as these become future cash cows for Embracer. Both Dead Island 2 and Remnant 2 have been successful, which will be important pieces for future catalog sales. The restructuring program that the company recently presented is expected to take effect in the second half of the year, which should substantially improve cash flow.

Xero

Xero can perhaps be best described as the New Zealand, international equivalent of Fortnox. The cloud-based accounting company operates in over 180 countries and had a turnover equivalent to 8.8 billion SEK last year.

The company reports biannually, and the latest report from May closed the fiscal year 22/23. On an annual basis, the company grew its revenue by 28 percent, while adjusted EBITDA rose by 45 percent. The cash flow margin increased from just over zero to 7.3 percent. However, the company will continue to work on improving its margins through efficiencies to optimize the balance between profitability and growth.

Reporting period with sharp fluctuations

It has been an exceptionally tough reporting period for the very smallest companies. A slightly weaker report has punished the stock price more harshly than perhaps warranted. However, it is clear that the mid-sized to larger Nordic companies with proven business models and strong cash flows continue to stand strong as a group.

On average, our fund's 10 largest positions grew their revenue by just over 20 percent organically in the quarter, while profit growth was over 30 percent on average! If we normalize Kindred's profit increase to 20 percent (instead of the reported 120 due to easy comparables), then the profit growth sums to an average of 23 percent. IF the companies continue to grow at the same rate, we assess that the likelihood is good for pleasant times ahead for those positioned within technology-driven growth!

Read more about the fund here.