Historical returns are no guarantee of future returns. The money invested in the fund can both increase and decrease in value, and it is not certain that you will receive back the entire invested capital.

Time to rebalance?

American tech giants surge – the Nordics stagnate

The last few years have been challenging for Nordic tech companies on the stock market, where their mediocre returns are compared against the astonishing growth that American tech giants have delivered to their shareholders. Besides the strong financial history that the Magnificent Seven companies possess, including the likes of Microsoft, Apple, Tesla, and Amazon, these giants offer global exposure, good liquidity, and are market leaders. So why consider anything else in tech?

Perhaps the most straightforward argument can sometimes be the most powerful. Over the past few years, revenue and profits have significantly increased for both the tech giants and the Nordic tech companies. While the Magnificent Seven have soared in price, the Nordic tech companies trade far below their all-time highs. To be more specific, the Big Tech index in the USA rose by 33 percent during 2023, while the Swedish tech index fell by about 15 percent—a difference of nearly 50 percentage points.

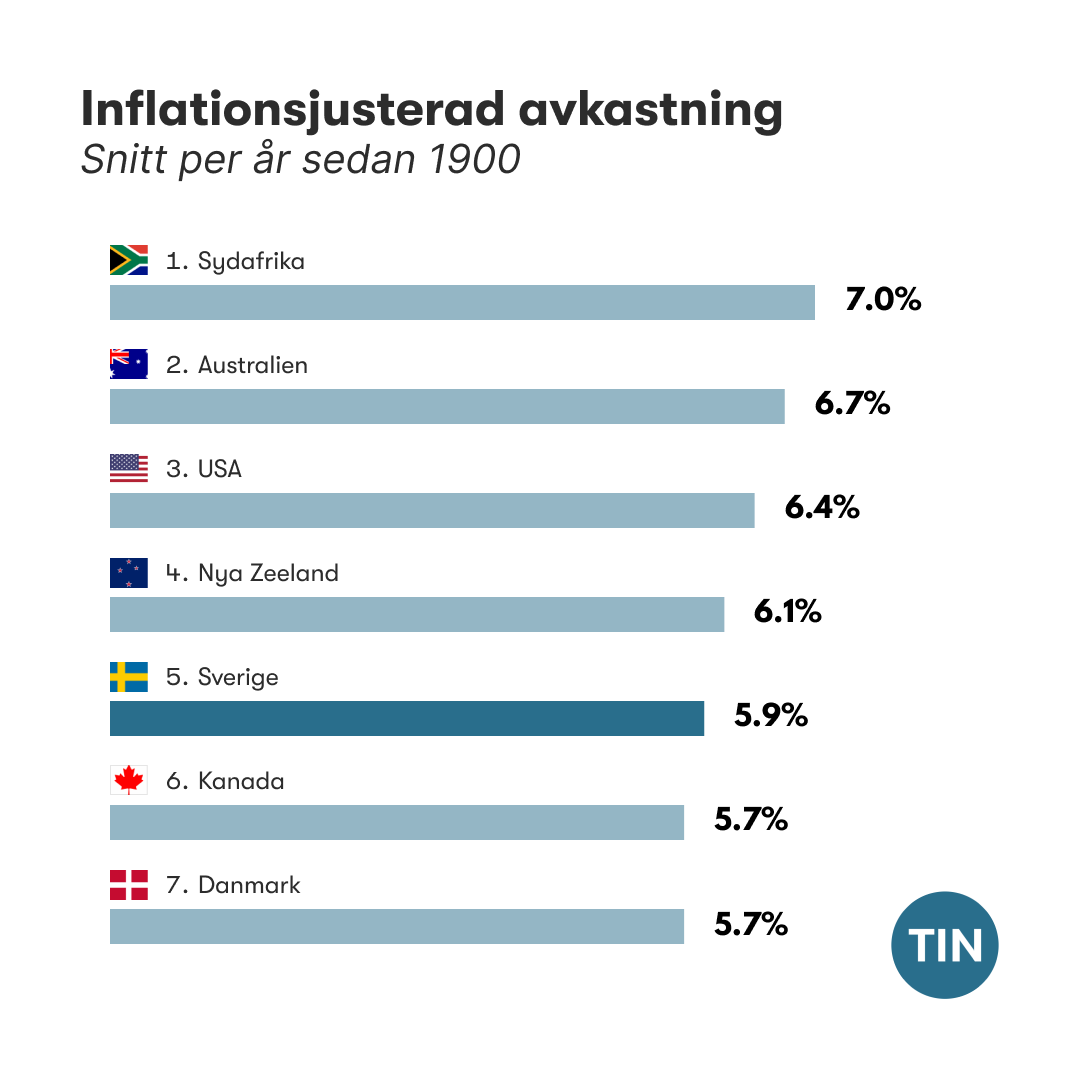

If we broaden our perspective, we can note that the Swedish stock market is on the top 10 list of stock exchanges with the highest returns since 1900. This suggests that the current, extreme difference is temporary rather than permanent.

The advantage of Nordic tech companies

Nordic tech companies have long been known for their strong innovation capabilities and ability to be at the forefront of technological advancements. Sweden has been in the top 3 of the WIPO's annual 'Global Innovation Index' for the past 15 years. It might not always feel that way when you think about how software functions in everyday life. But we Swedes are good at embracing digital innovations!

High competence and Swedes' ability to specialize in interesting niches create a unique position in the market. Add a healthy balance between reinvested profits and competitive dividends, and there is a lot to be attracted to. Moreover, investor protection is firmly anchored, ensuring that profits end up where they should – with the shareholders – and are not limited to employee options or government control.

How should one think moving forward?

Reflecting on the allocation of Nordic tech companies in your portfolio compared to global tech giants can be a wise consideration. If you had a basic idea a few years ago that you wanted, for example, 15 percent Nordic tech companies in your portfolio, you should consider whether anything fundamental has changed since you held that opinion. Are we still innovative? Have the companies managed to increase their profits at the rate I expected? So, it's not about the classic metaphor of 'pulling up the roses and watering the weeds.' We argue that there is a cluster of Nordic tech companies that are operationally roses, but where the price performance does not reflect the quality.

Therefore, considering rebalancing some of the profits from Big Tech companies, with a strong dollar behind them, to Nordic tech companies is more interesting than it has been in a long time. The three main arguments supporting this reasoning are:

- Sweden is a world leader in innovation, which is a key factor for revenue and profit growth.

- Nordic companies offer unbeatable corporate governance with strong protection for small investors.

- The valuation difference is greater than it has been in a long time.

It is important to point out that these considerations only represent our analysis of possible factors and should not be interpreted as advice.